A Little Q4 Planning Prevents a lot of Q1 Stress

Although finding time for organization and planning can be difficult, the arrival of the year’s fourth quarter is an excellent time to review systems and staffing in preparation for a busy year end and potentially busier Q1.

What transactions are in the pipeline? For some, end of year is the time to spend budget allocations and complete acquisitions of new companies or business lines. For others, results to date may result in a determination to wind down or spin off subsidiaries and get them off the books before year end. For companies and the lawyers who serve them, will existing staff be swamped making accomplishing the volume of work by 12/31 difficult? Or might skillsets need to be supplemented to take on projects that may not be part of the everyday workflow? Now is an excellent time to explore solutions and available services so when “crazy busy” hits, you’ll breathe a sigh of relief that you’ve got a plan.

Further into the new year, the first six months, and especially Q1 are among the busiest filing quarters with many states requiring periodic reports. Tax departments are equally busy with many tax returns due during this time. If there are business entities that are no longer needed, consider dissolving or merging them by year end. And if existing staff doesn’t have time to take on the special projects of justifying entities with tax departments, an experienced outsourced specialist can be a great solution. Eliminating entities on or before year end will save time and money for Legal and Tax by eliminating tax return and Annual Report filings in the new year. In many jurisdictions, existence for even one day will result in filing obligations.

Also consider the volume of periodic reports that may be due and think about existing processes for getting those filed. Is the right person completing these filings? Do those doing the filing have a solid understanding of business entities and how these filings are utilized in the different jurisdictions? Is it just a line item on a to do list, or are the filings given the proper attention to detail to ensure that they are filed timely and accurately? Are deadlines missed, resulting in late fees and penalties, or does the work day stop when a surprise deadline results in a scramble to complete filings on time? Is a company paying too much for these filings by having CPAs or other senior billing personnel complete them?

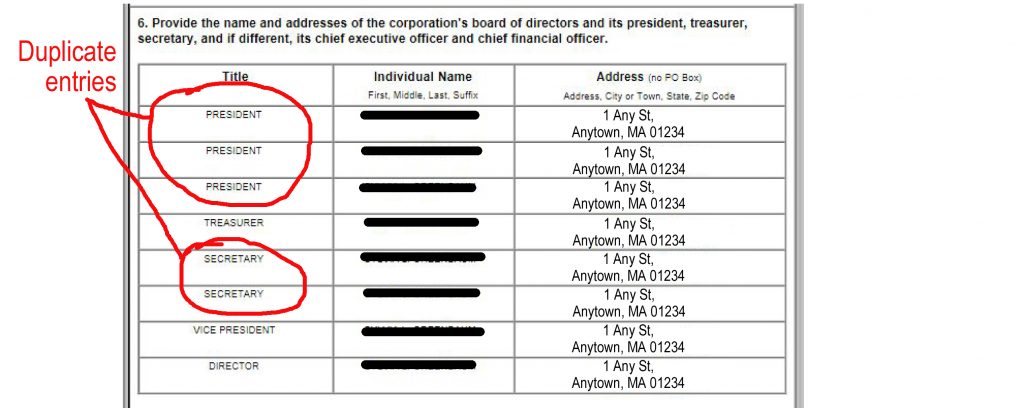

All too often here at Strategic Paralegal Services, we see Reports filed incorrectly or not at all – below is an image of an actual Annual Report filing – technically, a task fulfilled, but we prefer to have the task done well rather than just “done”.

Staffing resources, streamlining the corporate structure chart and annual report filing responsibilities are all places where a little planning now can pay huge dividends in the months to come.